Table of Contents

Introduction:

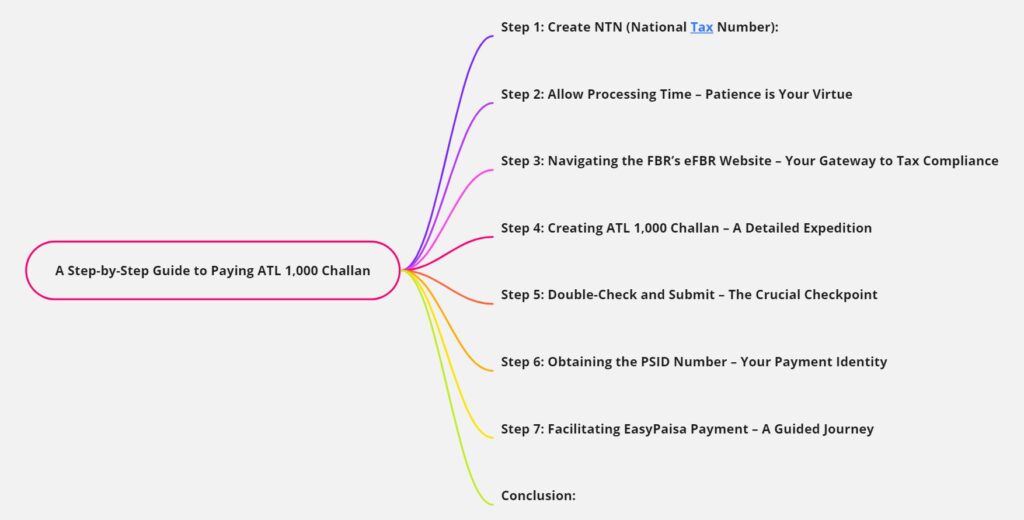

Assalamu Alaikum! Today, we will guide you through the A Step-by-Step Guide to Paying ATL 1,000 Challan to become an active taxpayer with the Federal Board of Revenue (FBR). This is an essential step to enjoy tax benefits, including a reduced tax liability. Let’s get started with the simple steps.

Step 1: Create NTN (National Tax Number):

If you haven’t created your NTN yet, you can follow the steps outlined in our YouTube video or refer to the detailed instructions in our blog post. Click the link to watch the video or read the post for a comprehensive guide on creating your NTN.

Step 2: Allow Processing Time – Patience is Your Virtue

Upon successfully obtaining your NTN, exercise patience. The system requires 12-24 hours to process your information, ensuring a seamless transition to active taxpayer status.

Step 3: Navigating the FBR’s eFBR Website – Your Gateway to Tax Compliance

Effortlessly access the FBR eFBR website using the link provided below. This is where your journey towards tax compliance officially begins.

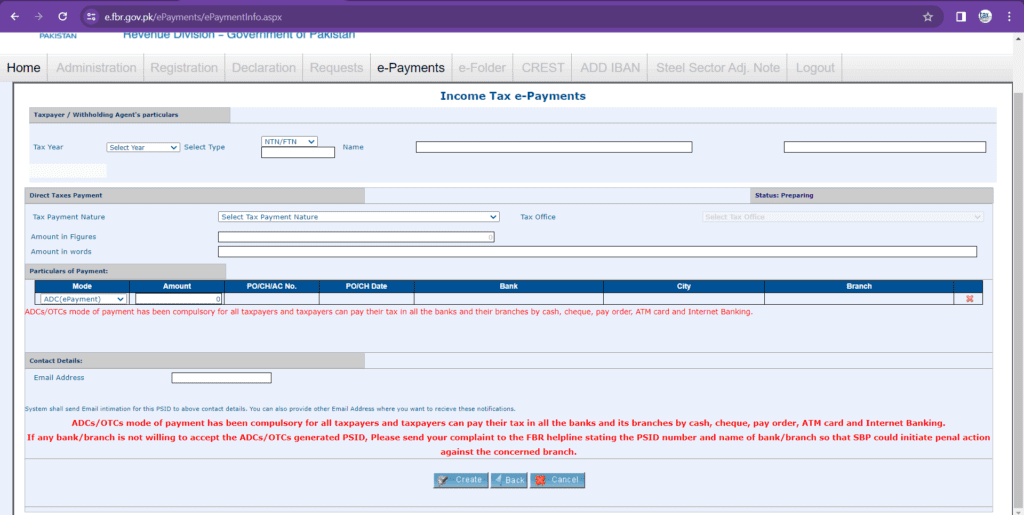

Step 4: Creating ATL 1,000 Challan – A Detailed Expedition

- Choose the relevant Tax Year based on the current timeline. If you are reading or watching this post between 1st March 2024 to 28th February 2025, then select Tax Year 2023.

- Input your CNIC (Computerized National Identity Card) for individual taxpayers.

- Under “Tax Payment Nature,” select “Miscellaneous.”

- In “Tax Payment Section,” opt for “182(A) – Surcharge for ATL 920602.”

- Input the payment amount in figures, specifying Rs 1,000.

- Reiterate Rs 1,000 in the “ADC Payment” field.

- Provide your valid email address.

- Click the “Create” button to proceed.

Step 5: Double-Check and Submit – The Crucial Checkpoint

Following the “Create” step, meticulously review all details. A new button, “Submit,” surfaces. Clicking “Submit” is the final checkpoint, ensuring accuracy before proceeding.

Step 6: Obtaining the PSID Number – Your Payment Identity

Congratulations! Your ATL Challan has been successfully created. Note the PSID (Payment Slip ID) number – a key element for online payments through various channels.

Step 7: Facilitating EasyPaisa Payment – A Guided Journey

Navigate to the Government Payments section on EasyPaisa. Select “Income,” paste the obtained PSID, verify the displayed amount of Rs 1,000, and proceed with the payment.

Conclusion:

With the completion of these steps, you’ve unlocked the path to tax compliance and benefits. We appreciate your support and commitment. Stay tuned for more insights into tax and finance matters. Your prayers inspire our commitment to providing valuable financial guidance.

Practical Example:

Introduction: Assalamu Alaikum! Join Aisha on her journey to becoming an active taxpayer with FBR. Follow this step-by-step guide as Aisha pays the ATL 1,000 Challan, unlocking tax benefits and reducing her tax liability.

Step 1: Creating NTN – Aisha’s Starting Point: Aisha, a young professional, starts by creating her National Tax Number (NTN). She follows our guide on YouTube [insert link] and blog post [insert link], ensuring a smooth NTN creation process.

Step 2: Patience is Aisha’s Virtue: Having successfully obtained her NTN, Aisha patiently waits for 12-24 hours for the system to process her information and activate her taxpayer status.

Step 3: Navigating the FBR’s eFBR Website – Aisha’s Gateway: Aisha effortlessly accesses the FBR eFBR website using the link provided in our blog post, marking the official beginning of her tax compliance journey.

Step 4: Aisha’s Detailed Expedition – Creating ATL 1,000 Challan:

- Aisha chooses Tax Year 2023 in line with the current timeline.

- Aisha inputs her CNIC for individual taxpayers.

- Under “Tax Payment Nature,” Aisha selects “Miscellaneous.”

- In “Tax Payment Section,” Aisha opts for “182(A) – Surcharge for ATL 920602.”

- Aisha inputs the payment amount, specifying Rs 1,000.

- Reiterating Rs 1,000 in the “ADC Payment” field, Aisha provides her valid email address.

- Aisha clicks “Create” to proceed with confidence.

Step 5: Aisha’s Crucial Checkpoint – Double-Check and Submit: Following the “Create” step, Aisha meticulously reviews all the details. With confidence, she clicks “Submit,” ensuring accuracy before proceeding.

Step 6: Aisha’s Payment Identity – Obtaining the PSID Number: Congratulations to Aisha! Her ATL Challan is successfully created. She notes the PSID (Payment Slip ID) number, a key element for online payments through various channels.

Step 7: Aisha’s Guided Journey – Facilitating EasyPaisa Payment: Aisha navigates to EasyPaisa’s Government Payments section, selects “Income,” pastes the obtained PSID, verifies the displayed amount of Rs 1,000, and proceeds with the payment.

Conclusion: Aisha Unlocks Tax Benefits: With these steps, Aisha has unlocked the path to tax compliance and benefits. We appreciate Aisha’s engagement and commitment. Stay tuned for more insights into tax and finance matters, inspired by individuals like Aisha.

Frequently Asked Questions (FAQs) and Their Answers

- How can I become an active taxpayer with FBR?

- Follow the steps in our detailed guide on obtaining an NTN and creating ATL 1,000 Challan.

- What are the benefits of having an NTN (National Tax Number)?

- NTN is essential for tax compliance, unlocking benefits like reduced tax liability and eligibility for tax exemptions.

- How long does it take for the E.FBR system to process my information?

- Allow 12-24 hours for seamless processing of your information after obtaining your NTN.

- Why is patience crucial during the tax registration process?

- Patience ensures a smooth transition to active taxpayer status as the system processes your information.

- What is the significance of the E.FBR website in tax compliance?

- The E.FBR website is your gateway to tax compliance, where you initiate and manage your tax-related activities.

- Can you guide me through the steps of creating ATL 1,000 Challan for tax compliance?

- Follow our detailed steps on selecting the relevant Tax Year, entering CNIC, and creating the Challan for Rs 1,000.

- What is the purpose of the surcharge for ATL 920602 in tax payments?

- The surcharge contributes to tax revenue and is a necessary step in fulfilling your tax obligations and becoming an active Taxpayer in Pakistan.

- How do I pay the ATL 1,000 Challan using EasyPaisa?

- Visit the Government Payments section, select “Income,” paste your PSID, verify the amount, and proceed with the payment.

- What is a PSID (Payment Slip ID) and why is it important for online payments?

- PSID is your payment identity, crucial for online payments, helping track and confirm your transaction.

- Are there any other tax benefits I can enjoy after becoming an active taxpayer?

- Yes, including potential deductions, exemptions, and reduced tax rates, depending on your financial situation and the tax laws.

How Can I Help You?

- Return Filing Services:

- Whether you need assistance with individual or business returns, I’ve got you covered. Your returns will be prepared professionally and under Income Tax rules.

- Customized Solutions:

- Do you have specific requirements or unique situations? Let’s discuss your needs, and I’ll tailor my services to meet your circumstances.

Contact Options:

- YouTube Description:

- Find my number in the YouTube description and drop me a message. I’ll get back to you as soon as I’m available.

- Website:

- Visit my website and give me a call or leave a message. I’ll respond promptly to address your queries.

- WhatsApp:

- Prefer WhatsApp? Feel free to send me a message, and I’ll assist you as soon as I’m available.

Professional and Rule-Compliant Services: Rest assured that the services provided will be professional and adhere to Income Tax rules. Your peace of mind is my priority, and I’m committed to offering you the best solutions.

Feel free to reach out whenever you have questions or require assistance with your income tax matters. Looking forward to helping you navigate the world of taxation seamlessly! JazakAllah!